How to Objectively Measure the "Fundability" of Your Fund

When I wrote this post about trying to measure the fundability of your startup, I kicked it off with, “You can’t” and proceeded to share all the ways that getting your company funded feels a bit like a craps shoot, while still trying find a method somewhere within the madness.

On the other hand, I feel things are a lot more predictable on the fund side—and that getting limited partners for your fund or syndicate is a lot more grounded in something that resembles logic. Normally, I can tell whether or not a VC will be able to raise capital for their fund at the particular size they’re trying for—and if not that size, what the market might bear at this stage.

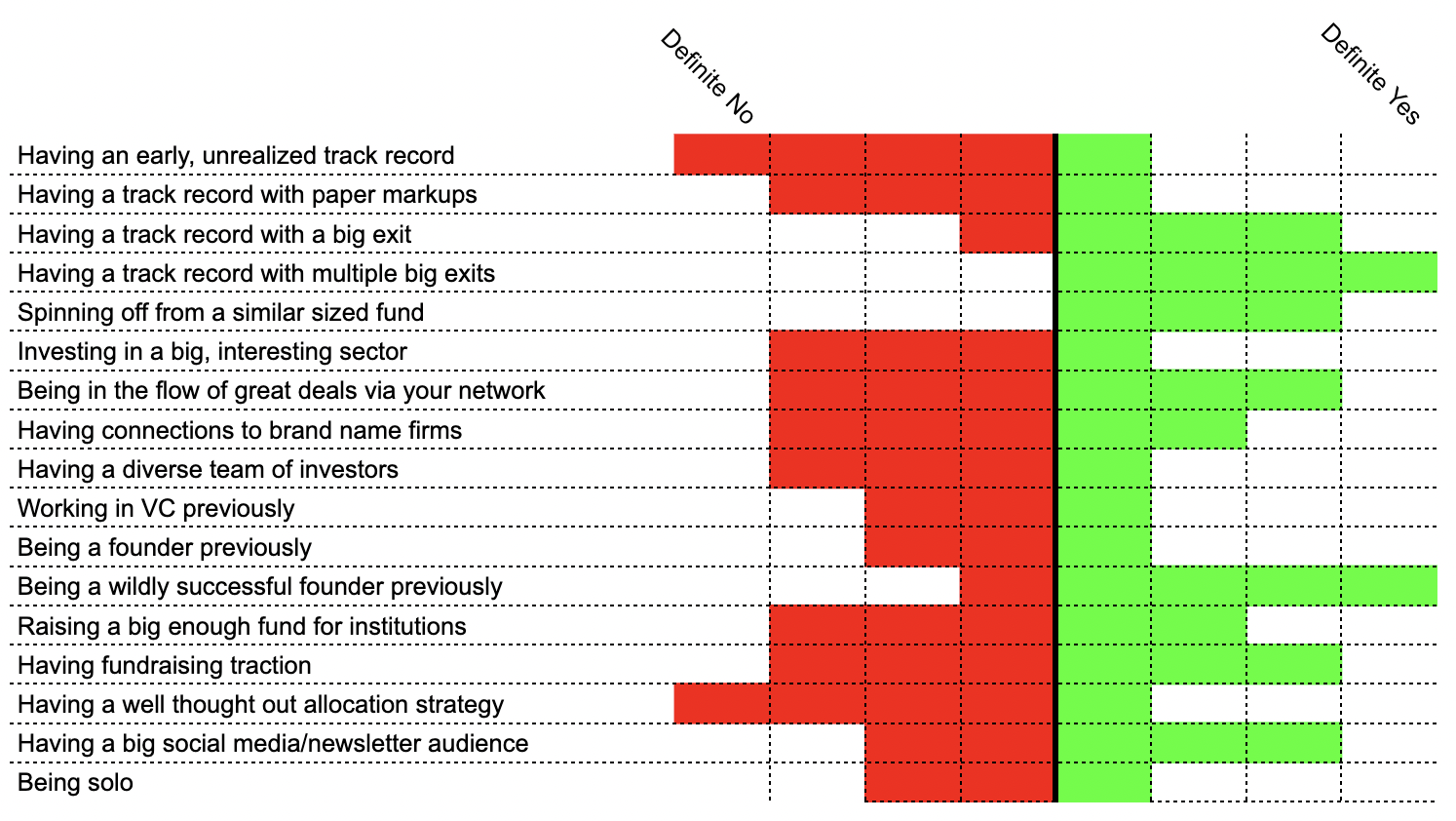

Here’s my view of how “fundability” plays out for funds:

The red bars indicate the downside of what happens when you don’t have that things and the green bars are the upside if you do have it. Spinning out of a successful fund of a similar size? Awesome—your track record, experience, and existing relationships will have you off to the races. Not the case? That’s fine, because that’s just not the case for most managers, so there’s no real harm in not having it.

On the other hand, not having a track record at all, unrealized or realized, is really going to hurt you significantly, whereas just having an early, unrealized one won’t score you much in the way of points.

Are there proxies for track record? Yes, as track record is a combination of deal flow and deal selection. You can show that you have deal flow, for example, by being a highly sought-after marketing advisor to top Y Combinator companies and that you’ve picked up equity options in these companies previously. Perhaps you run a widely syndicated startup newsletter where the best companies have been subscribers for years.

You could show selection ability because you’ve only chosen some of these companies to work with as a consultant and several of them have turned out to be big successes.

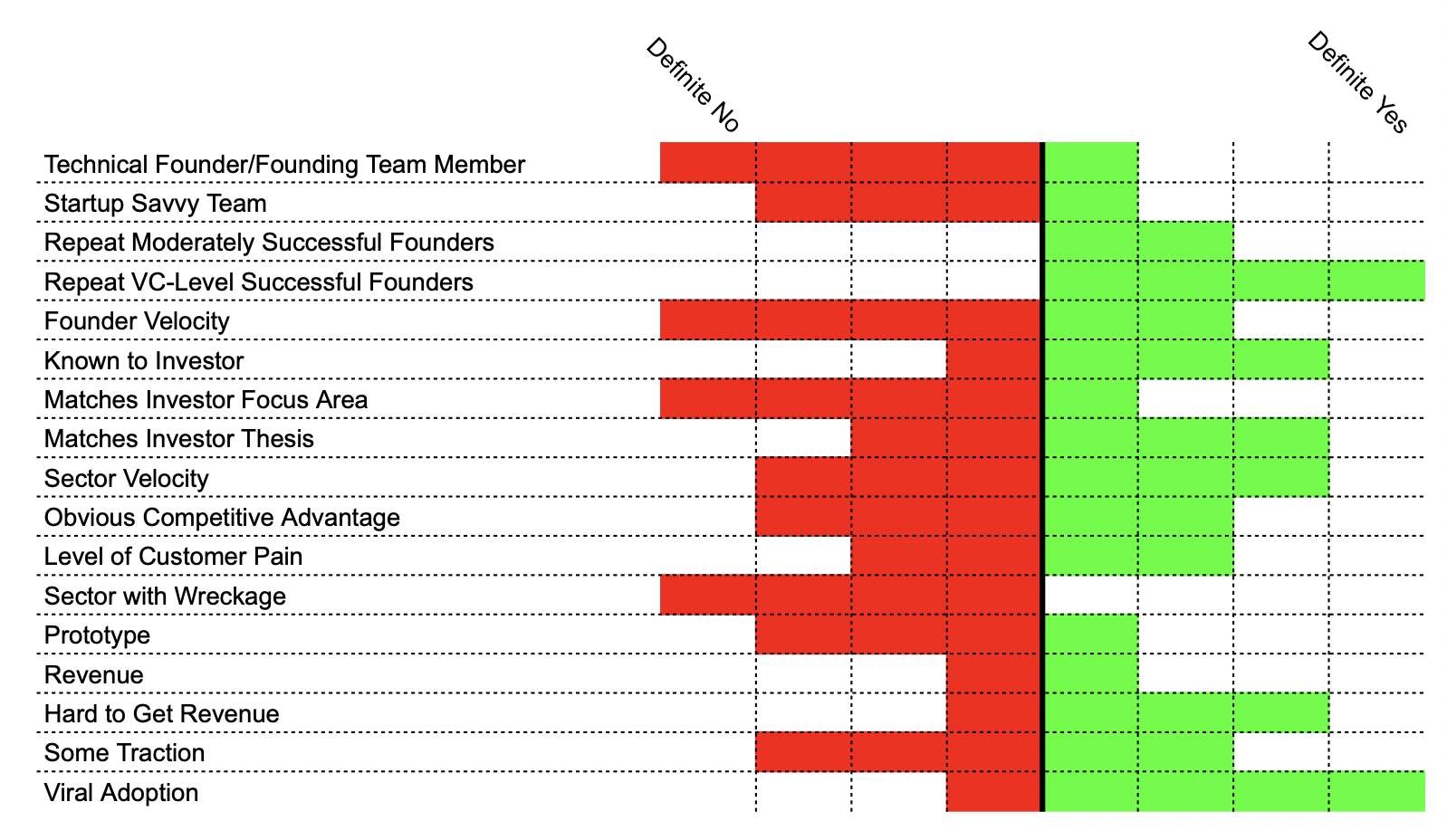

Generally speaking, I think it’s easier to answer the question, “Is this manager going to be sought after to fund the best opportunities in X space/geo/etc?” than it is to try to figure out whether an individual founder will be successful with a particular startup idea. Once you’ve answered that question, you can dive into their ability to sort through their deal flow, do deal selection and the administrative functions of running a fund. Most of the criteria I listed above is all about being someone the very best and highest potential founders want on their cap table—and that’s the most important path to having great returns.

A few things to keep in mind when you try to raise a fund:

Are you asking people to back activities you’re already doing because you have additional allocation available—like an angel that could have gotten more in your best deals if you had that cash—or are you asking people to imagine that you’ll be good at a set of things you haven’t actually done yet?

Are you currently in the flow of great opportunities or are you hoping that having a fund will give you a seat at the table? If you’re in an underserved market, a fund might be all you need, but too many people are trying to raise hoping the capital itself gives them access and deal flow.

Are you raising a size-appropriate fund?

Can your target investors write checks of this size?

Does the step-up between what you did previously and what you’re asking to do going forward make sense, or did you put $500k of angel capital to work, and now you’re asking to turn that into a $100mm fund?

Going from an angel to a fund manager is a huge jump—as is going from a junior person at a fund to the main person at your own fund. It could take a long time to convince people you can make that leap, but you want to stay in motion as much as possible during that time—remaining in market, keeping your network warm.

Some investors do that through the use of syndicates—which is why I’m super psyched to be working with Sydecar on a VC coaching giveaway. Three emerging/aspiring investors will win a two-session package where we can talk about the fundability of your fund, your thesis, deal flow sourcing, and LP fundraising—and we’ll leave the actual deal execution part to the folks at Sydecar.