Coming from the Limited Partner side, I've had the opportunity to see investing in private equity from high level portfolio allocation perspective... leveraged buyouts, venture, distressed investments, etc.

It always struck me when people talked about making an "allocation" to venture capital, as if it was somewhere that you could just stick a lot of money and get something close to historical returns. Not only is that not true, but I think that what most institutional investors even call "venture capital" is a terrible catch-all for a pretty diverse set of investment strategies across a number of uncorrellated industries.

I mean, should a $50 million investment in a profitable and growing healthcare services company from a group like Summit Partners fall into the same "asset class" as a small angel/seed round in a company like del.icio.us that started out with one guy and one server? Do those investments have any correlation whatsover?

Granted, when the public markets are doing well, rising tides tend to float all ships and that's when you get outsized "VC" returns. But, keep in mind that one of the best venture investments ever, Google, was made during one of the worst possible periods of venture investment... ever. Google's first VC round game in June of 1999. How many other companies that got their first round of investment in June of 1999 are even still around? Selecting from that vintage would be an exercise in catching... well... forget falling knives... try falling hand grenades... oh, and one golden egg, of course.

The reality of venture capital is that its a relationship business where reputations and industry expertise count. You're betting on people... people who are betting on other people. The idea that you could group all of these people in one bucket and make assumptions and predictions that all of these people are going to move in step always seemed a bit silly to me. Just because you can aggregate data doesn't mean you should.

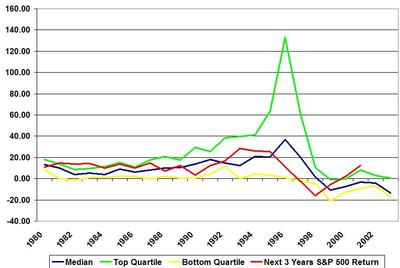

In fact, if you're not betting on the right people, its really not even worth being in this "asset class" to begin with. Take this chart. This chart plots "vintage year" returns across time of the top quartile, median, and bottom quartile of VC funds. So, for example, this chart says that the green spike is the aggregate IRR of the top quartile funds that began in 1997. So, that money was largely put to work in '97, '98, and '99, and those companies exited in the '99 and '00 timeframes... a great time to exit, but not a great time to start putting your money to work as you can see from the really low returns garnered by even the best managers who raised their funds in '99.

I plotted these returns against the next 3 years returns from the S&P. Its not exact, but it gives you a sense of what your money would have been doing in the public market over the next few years if you had put your money in public stocks as an alternative.

I plotted these returns against the next 3 years returns from the S&P. Its not exact, but it gives you a sense of what your money would have been doing in the public market over the next few years if you had put your money in public stocks as an alternative.

What is says is that venture really only makes sense if you are with the right firms. Even the median venture manager doesn't outperform the S&P 500, particularly when you take risk into consideration.

So when people say, "I'm bearish on venture" are they talking about median managers or top folks, because I'll always be bearish on median managers, but I'd be happy to invest with the best of the best, no matter what the market looks like for public exits, IT spend, etc. In fact, it is great innovation by the best of entreprenuers that often drives these markets and spending. I'm sure any CTO would find the money for the next big idea that solves all of his or her problems no matter what their budget looked like.

The bottleneck here is access. Not everyone can get into the best managers. In fact, if you're a new investor, you might even have trouble getting into even the second tier. But everyone who invests on the LP side thinks their managers are the best, right? And obviously, not everyone can be the top quartile, as the saying goes. How many people are top tier? Who are they? Well, that's a whole debate in and of itself, but I'm just more concerned with the idea that investors look at venture capital as a homogeneous set of investments that can be slotted into an efficient frontier, because its quite the opposite. Investors need to consider their own opportunity set, due diligence their managers thoroughly, and make bets on people the same way VCs do. How much money could you actually put to work with managers you think you have the right relationships and industry knowledge to succeed?

I mean, can you imagine if we decided here at USV to make a 25% allocation to "online advertising" and put our money out that way, regardless of what kind of entreprenuers walk out the door? Certain not a good style of investing and not the way I'd pick VCs either.